Janus Henderson: Demystifying EMD hard currency

Emerging markets are entering a new era of decoupling in growth from the rest of the world. Different countries and diverse return drivers can be accessed through emerging markets debt hard currency.

By Thomas Haugaard, Portfolio Manager, Janus Henderson Investors

A decoupling story

As we near the end of the tightening cycle, there is debate regarding the severity, but the consensus is that global growth is slowing. This is where differentiation can emerge in economic growth amid policy differences – after all, emerging markets (EMs) were the first to kick off tightening and so could be ahead in easing.

Policy-driven headwinds are also more significant for developed markets (DMs) than for EMs. In DMs, the monetary policy transmission channel is, in our view, stronger given overall higher indebtedness. Stronger commodity prices are also more favourable for some EMs, which stand to benefit from the China growth rebound. Emerging markets growth is expected to increasingly decouple from the rest of the world. Growing three times as fast as DMs, these economies are expected to account for nearly 80% of global growth over 2023 and 20241.

A broad and liquid universe Since EMs are the powerhouse of the global economy, is it even possible to avoid being exposed to them through investment portfolios? We would argue that investors have indirect exposure even without direct investment and so accessing compensation for this makes sense. The emerging market debt hard currency (EMD HC) universe is an asset class where the opportunity set is the broadest in terms of global coverage.

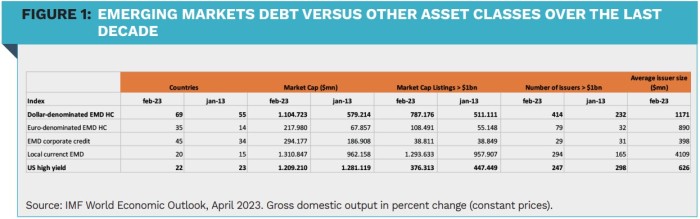

The EMD HC universe has grown from 55 countries to 69 countries over the past decade, eclipsing the country breadth of the EM corporate bond and local currency universe (Figure 1). The EMD HC universe has grown to be almost comparable in market cap to the US high yield sector. Also representative of this large liquid universe, the average EM sovereign issuer is around twice the size of US high yield and EM corporate issuers, making sovereign pricing transparent.

Different countries, diverse return drivers

Amid pervasive uncertainty, the merits of diversification feel most valuable. The broad EMD HC country universe is evenly balanced between investment grade and high yield and spans all regions. No country measures much more than 5%, unlike other EM indices, where China dominates2. This variation enables effective diversification through offering access to different growth drivers – such as longterm structural drivers – and risk characteristics.

Where a differentiation in fundamentals can aid with risk diversification is, for example: investment grade versus high yield, high income to middle income, and commodity exporters versus importers. As economic development never rests in EMs, this creates an opportunity to participate in any improvement, which often can underpin a rating upgrade story for a sovereign.

Myth: EM is just levered DM

Another misconception is around the inextricability of the EM and DM cycle, which, given slower global growth and higher borrowing costs, fuels default fears. The differential between EM and US real GDP growth is set to increase in 2023 and 20243 , as EMs outpaces the US (particularly given the China rebound), while correlation of growth has waned4.

Moreover, there may not be as close a relationship as assumed between the US monetary cycle and the performance of the EMD HC universe. With US Federal Reserve tightening influencing EMD HC performance, much depends on the visibility and certainty around the US rate cycle and the state of the US economy. A more consistent trend is that EMD HC tends to outperform in the two years after the end of a US hiking cycle5, perhaps partly due to the relative attractiveness of EMD.

Myth: default risk is high

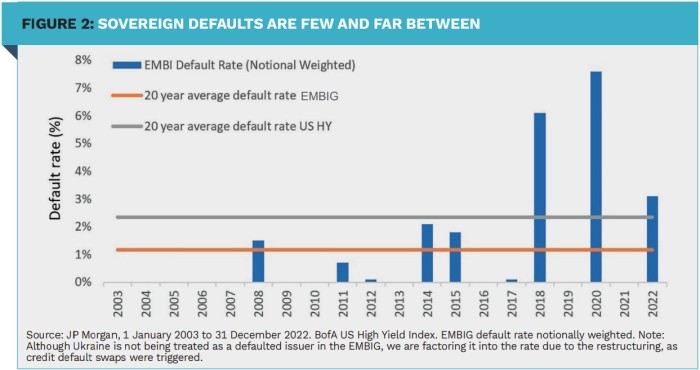

EMs have also progressed by upgrading policy frameworks, where most bigger EM countries have comparable frameworks to DMs. Positive development is encouraged through greater involvement of the International Monetary Fund (IMF). After the 1980s, sovereign defaults tended to be sporadic and reached quicker resolutions through partnership with such institutions. According to Morgan Stanley, three quarters of sovereign debt restructurings since 19996 involved partnership with the IMF – with a programme nearly always agreed ahead of the restructuring closing. Over the past nearly two decades, the EMD HC average default rate has been circa 1% per year (compared to just over 2% in US high yield), with an average recovery rate of more than 50% (see Figure 2). Despite this, the market perception of defaults is disconnected with historical reality and the perception of EM does not fully factor in the policy improvements and structural reform over the last two decades.

Looking past pre-conceptions

Some pre-conceptions surround EMD that are an overhang from the past and overlook the maturing of EM economies in improving policy quality in governance and fundamentals. As we enter a more challenging period, the broad EMD HC universe offers investors diversification as well as the prospect of compelling growth as EMs decouple from DMs and policy tightening reverses. More attractive yields have also emerged, highlighting the income opportunity. That said, there is a lot of dispersion in this heterogenous universe. An active approach can help distil the opportunities and balance the risk and reward on offer to generate steady alpha over the long term.

1 Source: IMF World Economic Outlook, October 2022.

2 Source: Janus Henderson Investors, JP Morgan, as at 31 December 2022. JP Morgan EMBI Global Diversified Index.

3 Source: Macrobond, IMF, Janus Henderson Investors, as at 7 March 2023. There is no guarantee that past trends will continue, or forecasts be realised.'

4 Source: Tellimer Research, IMF WEO, 31 December 2019. Correlation refers to 2010 to 2019.

5 Source: Tellimer Research, St Louis Fed, Bloomberg. Bond returns based on the JPM EMBIG, 2021.

6 Source: Morgan Stanley, 4 October 2022

|

SUMMARY EMD HC offers unrivalled scale, compelling diversification and attractive return potential. Myths pervade the EMD asset class, detaching perception from reality around defaults, leverage to the DM cycle and ESG risks. In the sovereign space, the unique nature of these borrowers mitigates default risk, while the broad issuer base allows investors to tap into diversification potential. |

|

Disclaimer The views presented are as of the date published. This article is intended solely for the use of professionals, defined as Eligible Counterparties or Professional Clients, and is not for general public distribution. Janus Henderson Investors is the name under which investment products and services are provided by Janus Henderson Investors International Limited (reg no. 3594615), Janus Henderson Investors UK Limited (reg. no. 906355), Janus Henderson Fund Management UK Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no. 2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Janus Henderson Investors Europe S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier). Janus Henderson, Knowledge Shared and Knowledge Labs are trademarks ofJanus Henderson Group plc or one ofits subsidiaries. © Janus Henderson Group plc. |