Harry Geels: Important lessons from our sick neighbor Germany

This column was originally written in Dutch. This is an English translation.

By Harry Geels

There are at least six reasons why Germany is currently the sick man of Europe. This is a cause for concern, because the Netherlands is economically dependent on Germany. There are also a few special lessons to be learned.

In January this year, thousands of farmers marched in Berlin to protest against the abolition of a number of tax benefits announced in the context of the climate transition. But the dissatisfaction among Germans in general and German farmers in particular has a deeper cause. Our neighboring country is not doing well economically. At least six causes can be identified for this (numbers 2, 3 and 4 also apply to the Netherlands). Before we discuss these, first some economic facts to explain the disadvantage that the average German has suffered.

Weak economic statistics

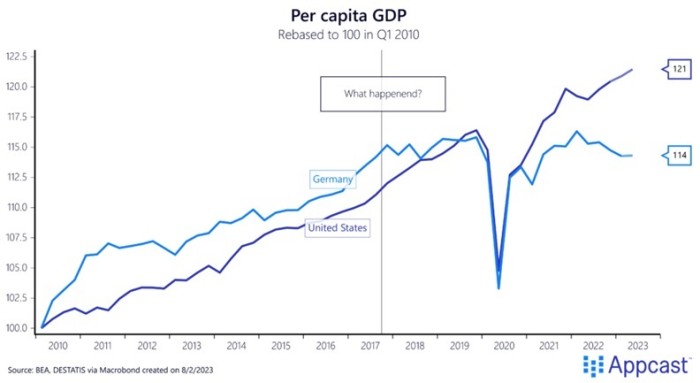

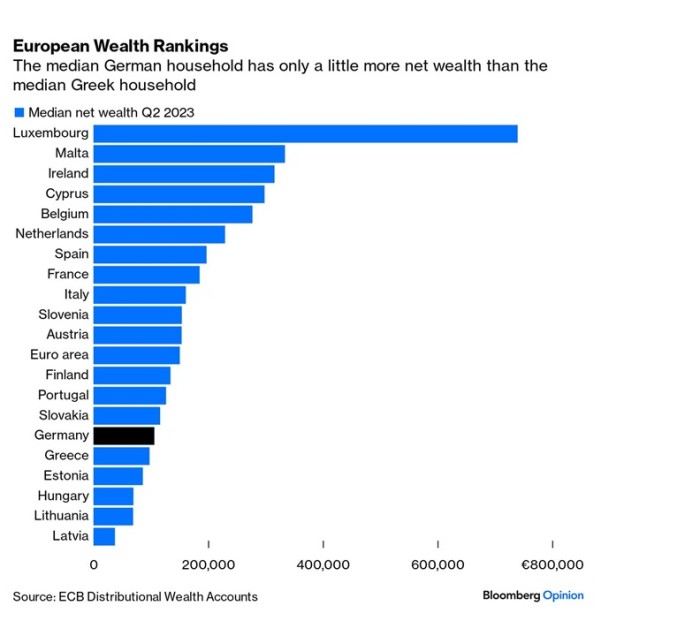

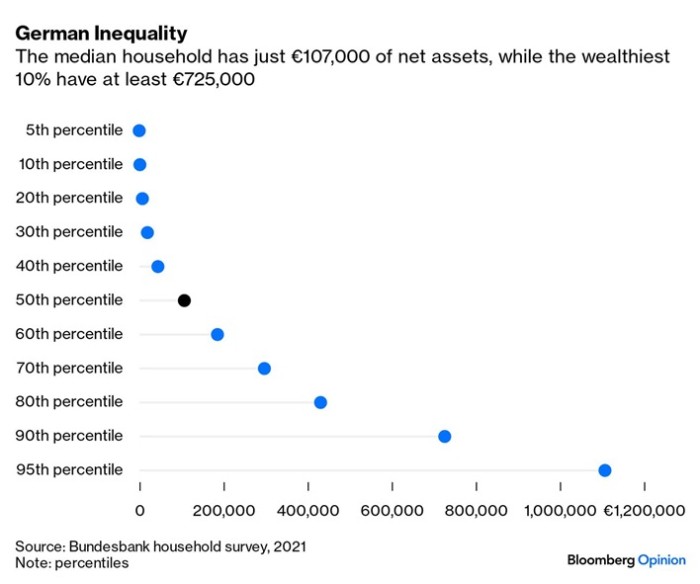

Germany has had to deal with limited economic growth since the corona crisis, especially in relation to other major economic regions in the world, such as China, India and the US. Figure 1 shows that GDP per capita in Germany has clearly started to lag behind that of the US. In recent years there has even been impoverishment. In addition, there is great wealth inequality in Germany. The median wealth is smaller than that of the Portuguese or the Slovak (Figure 2) and only slightly greater than that of the Greek. Moreover, the wealth is owned by the top 10% of the population (Figure 3).

Figure 1: GDP per capita, Germany versus the US

Figure 2: Median wealth per capita, in subset of EU countries

Figuur 3: Grote vermogensongelijkheid in Duitsland

Six worrisome developments in Germany

As mentioned, there are six important reasons why things are not going so well in Germany.

1) Dependence on China and competition with Japan

Germany is dependent on China for its exports. But while everyone in China used to drive a Volkswagen, nowadays they no longer do so. Not Germany but China is flooding the world market with (electric) cars. Furthermore, Japan is Germany's natural competitor and the weakening of the yen in recent years ensures that Japan (cars, capital goods) can compete with Germany much better. Germany used to lead the way in innovation and quality. Those days are long gone.

2) Bureaucracy

Anyone who searches the internet for Germany, Bureaucracy, and Memes will be in for a treat. Germany is one of the most bureaucratic countries in the world, although it is not much different in neighboring countries. Countries such as Luxembourg, Belgium, the Netherlands, Denmark and France are also bureaucratic. These are all countries where government expenditure represents more than 40% of GDP and on average 30% of workers are civil servants. Research shows that too much bureaucracy hinders growth: government organizations are not known for their productivity growth.

3) Complex tax system

Although Germany ranks in the middle of the pack in terms of average tax rates, its tax system is considered complex due to 1) multiple types of taxes, with each tax type having its own rules, deductions and exemptions, 2) progressive income tax with tax brackets, 3) many tax treaties to prevent double taxation on income earned abroad, 4) enormous amount of case law, which makes tax laws open to interpretation, and 5) regional differences, as Bundesländer also levy their own taxes.

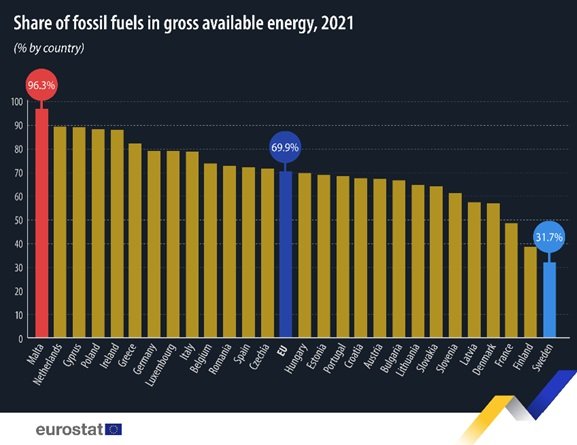

4) High dependence on fossil fuels

Over the past century, Germany has built its economy mainly on fossil fuels. It ranks 7th in the EU with regard to the use of fossil fuels (see Figure 4, by the way, the Netherlands scores even worse here). The business community of the top consumers suffers from the relatively high (fossil) energy rates. American and Chinese businesses have access to much cheaper energy. The US because it is self-sufficient and has lower tariffs and China because of the now cheap Russian energy.

Figure 4: Use of fossil fuels in EU countries

5) Culture of risk aversion

Germans tend to be more risk averse than many other Europeans. For example, German culture traditionally places great value on stability, security and long-term planning. Strong emphasis is placed on reliability, punctuality and compliance with rules and procedures. Furthermore, Germans are known for their high savings quota and their aversion to debt. The country has a tradition of saving for the future, including retirement planning and homeownership. This approach favors certainty over speculation. Furthermore, German education emphasizes practical and technical professions over finance and entrepreneurship. In short, Germans are known for their conservative investment behavior, and they also tend to do business with expensive financial providers.

6) Companies have poor access to capital markets

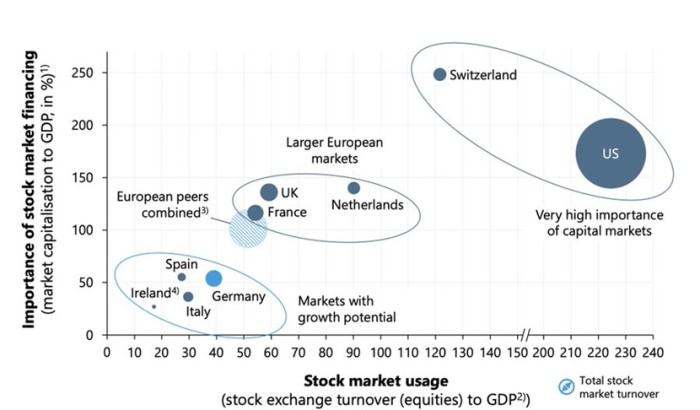

Germany relies much less on the free capital markets. This applies to both the public stock exchanges and the private markets (venture capital and private equity). Shares are often family owned and if financing is required, this is largely done through the banking system. This has the advantage that there is less risk in the system, but the disadvantage is that it is more difficult for start-up companies and large companies that need a turnaround to finance themselves. Figure 5 shows that Germany is at the bottom left in terms of the importance of the stock exchanges. This hinders (green) growth.

Figure 5: The importance of the stock market as a source of financing

Source: AFME

To conlude

In a widely read recent article by Bloomberg, the situation of our eastern neighbor was aptly summarized as follows: 'Why Germany is rich, but the Germans are poor and angry'. The bureaucracy must be cut and the business community must have access to cheaper energy and more efficient capital markets, to prevent even more German companies from investing elsewhere, such as in the US and China, or even stopping altogether. The Netherlands does not suffer from all the ailments of the German disease, but it comes close. So we have been warned!

This article contains a personal opinion from Harry Geels