La Française: Does remote working favour office markets in German B-cities?

By Virginie Wallut, Director of Real Estate Research and SRI

Remote working, at least two days per week, will no doubt trigger a geographic splintering of the real estate market. B-city markets, recognized for their better quality of life, are likely to attract the workforce of tomorrow.

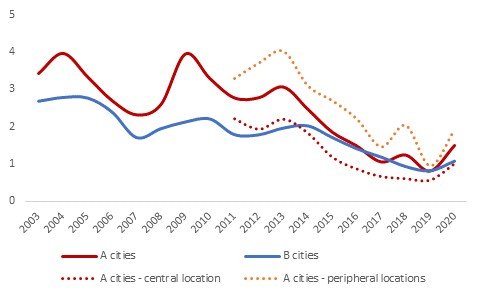

Historically, B-city markets have behaved more defensively and generated more stable returns over the long term. The below graph illustrates how the demand to supply ratio (an indicator of market tightness) has evolved over time. A low ratio indicates an undersupplied market (owner’s market). A high ratio indicates a market where demand may struggle to absorb supply (tenant’s market).

Supply/demand ratio in selected cities in Germany

Source : CBRE, PMA, La Française REM Research

Historically and especially during times of crises, B-city markets have been more balanced, with demand proportionate to supply. This situation is likely due to more restrictive financing conditions for developers in regional markets and therefore to fewer speculative construction projects. B-city property markets are generally speaking better positioned to manage a decrease in demand and absorb more swiftly any oversupply which would be due to the time lag between construction and delivery.

In 2020, the overall volume of take-up declined less in B-cities than in A-cities because of their economic fabric. B-city markets are made up of Small or Medium Sized Businesses or Industries (SMEs and SMIs) that are more agile and proactive in their real estate decisions as opposed to larger groups that drive take-up in A-city markets. Furthermore, while supply has increased relatively moderately in B-cities, 5% y-o-y, it has increased more markedly in A-cities, +20% y-o-y. (Source: CBRE)

The above graph reveals, however, that the average supply/demand indicator of A-cities does not correctly reflect certain geographic disparities. A-city center locations present the same defensive behavior as B-cities whereas A-city peripheral locations are much more cyclical and exposed to the economic consequences of crises. The lower supply in A-city central locations is undoubtedly due to the scarcity of constructable property rather than to any reluctance on the part of banks to finance development projects.

However, quantitative indicators cannot tell the whole story. The health crisis has accelerated the polarization of office markets. Remote working will not cap the demand for office space, but it will create new needs that cannot be accommodated by the existing office stock for technical reasons. On the one hand, we anticipate an acceleration in the obsolescence of certain office assets that no longer meet user demands. On the other hand, we anticipate a high demand for offices that meet the new expectations of users (i.e., offices that are flexible, sustainable and connected, with a wide range of services, improved accessibility, layouts capable of ensuring satisfactory sanitary standards).

Only the most modern offices will be able to respond to these new work patterns. More than ever, the quality of assets is essential. However, B-cities are faced with a lack of state-of-the-art offices. At the end of 2020, only 16% of the office stock in B-cities had been built within the past twenty years. (Source: CBRE) This means that 84% of companies currently occupy buildings that were delivered more than twenty years ago and that are in need of major renovation work in order to deploy hybrid organizations.

In conclusion, by on the ground investment specialists

We therefore believe that B-city markets present particularly interesting defensive characteristics in the current phase of the property cycle. Mark Wolter, Country Head - Germany and Managing Director of La Française Real Estate Managers – Germany, added, “The wide heterogeneity of the German market is an asset in this context and is increasingly putting a variety of prosperous B-cities into focus.”

However, it is essential to assess the characteristics of assets in light of new user habits in order to avoid unwanted downward pressure on rent levels and property valuations that would naturally arise as tenants vacate obsolete office space. Sandra Metzger, Deputy Managing Director of La Française Real Estate Managers – Germany, concluded, “Building quality is key in today’s changing environment. From our experience, tenants are actively searching for highly flexible, modern and sustainable office space, which is still lacking in most German B-cities. This represents an interesting opportunity for value creation.”