NN IP: Carbon emissions are expected to reduce further in 2022

Pushed by regulatory obligations and societal expectations, more and more companies are setting emissions-reduction goals in line with the Paris Agreement. Timely estimates of their performance in reaching these goals are of the utmost importance to responsible investors. To address the time lag in emissions reporting, NN Investment Partners (NN IP) has developed a model using artificial intelligence (AI) to forecast carbon emissions intensities.

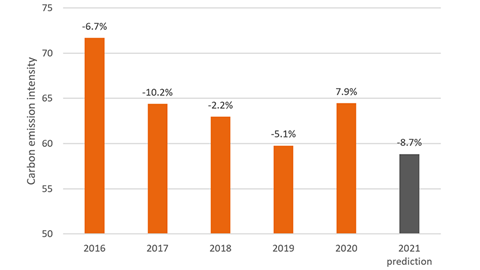

Companies are likely to report significant progress on carbon reduction in 2021, according to the latest data from the NN IP carbon forecast model. The model, which captures data from over 4,000 global companies, showed an aggregate predicted decline in carbon intensity of 6.4% for the full year. For the set of companies that have been reporting since the Paris Agreement (from 2016 onwards), the median carbon emission intensity for that group is projected to show an improvement of 8.7% over the same period. The median carbon intensity should fall to the lowest level since the Paris accord.

Jeremy Kent, Senior Portfolio Manager Sustainable Equity, at NN IP says: “This improvement seems to reflect actions being taken by many companies in driving down emissions intensity to meet regulatory obligations and societal expectations. In addition to this, the reopening of economies from pandemic lockdowns along with inflationary aspect has led to jumps in revenue in many industries while emissions levels increased only slightly, resulting in improvements in emissions intensity readings. Currently, intensity levels across all sectors are expected to improve, but there is clear differentiation between leaders and laggards.”

Corporate carbon intensity changes since the 2015 Paris Agreement

Based on 1,141 firms reporting consistently since 2015. Source: NN Investment Partners.

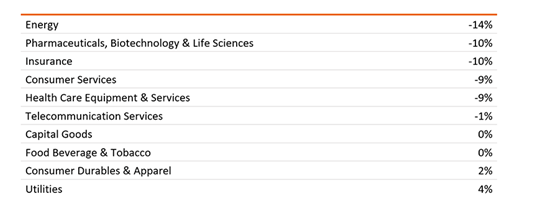

Sector differences

In the energy sector, surging oil prices have pushed up corporate revenue, resulting in much lower intensity readings even if the actual level of emissions didn’t change very much. However, lower intensity levels due to a higher revenue figure could lead to a detrimental environmental impact as the higher energy prices could prompt a switch to more emissions-intense energy production.

On the opposite side of the equation, the insurance industry has significantly lower absolute emissions but is among the leaders in improving intensity levels, making changes that may bring about structurally lower emissions. A significant amount of the emissions for insurance companies is related to travel, which dropped sharply during the pandemic and has been slow to return. It may now remain structurally lower than pre-pandemic levels; at the same time many of the companies in this sector have made commitments to drive down emissions with an emphasis on carbon offsets.

Predicted 2021 change to median sector carbon intensity (top/bottom 5)

Carbon intensity is defined as emissions per unit of revenue. Based on 1,141 companies reporting consistently since 2015. Source: NN Investment Partners.

Why use AI to predict emissions data?

The emissions data needed for investors to evaluate companies’ progress towards their targets is subject to delay. The time challenge with carbon emission data has two elements: low frequency of observations and the time-lag in reporting to investors. Carbon emissions are typically reported once a year, together with (or after) the release of an annual financial report. In addition, data vendors sometimes add to the challenge by updating their databases only periodically. This means that it is not uncommon for the most recent information available to investors to be about emissions that took place two years ago. This is problematic in an environment where regulation impacts a company in real-time and investors need to process current information to make informed decisions.

By concentrating on their real actions instead of the targets, the NN IP model seeks to predict the latest year’s carbon intensity. Our Sustainable Equity team partnered with the Investment Science team from the Innovation and Responsible Investment platform to develop the AI model for predicting emissions intensities.

The model focuses on predicting carbon intensity per unit of revenue, as absolute emissions can vary significantly based on factors such as acquisitions or disposals and thus may give a distorted view in terms of comparability. With revenue as the denominator in the model, sectors experiencing rapid revenue growth can show some of the greatest improvements in carbon intensity. The model allows the portfolio managers to zoom in on specific portfolio holdings and identify the companies that are predicted to record an improvement or a deterioration in carbon intensity.

Sebastiaan Reinders, Head of Investment Science at NN IP adds: “Plotting the predicted change of carbon intensity across portfolio holdings is an insightful exercise, which enables us to rank predicted best- and worst-performers. Comparing those predicted changes in portfolio intensity with changes based on actual reported figures is a useful way to spot the companies that look to be on track for steady progress in intensity reduction, or those that diverged, positively or negatively. The latter data point is particularly interesting, as it allows portfolio managers to have a rich discussion with companies' management on the plans underpinning carbon intensity reduction targets, and on any road-blocks or enablers to achieve those in the targeted timeline.”